Debt information

Debt investor relations is managed by Group Treasury. This team is the first point of contact for any debt related queries and can be contacted using [email protected].

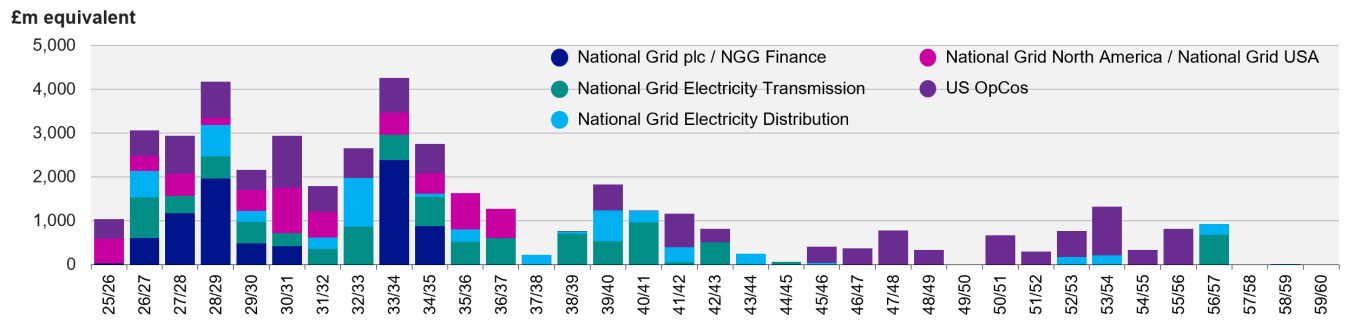

National Grid long term debt maturity profile

Image

Data as at 30 September 2025. The indicative exchange rate used is GBPUSD = 1.34455. Hybrid bond maturities to first call date.

The x axis states the financial year the debt matures, whilst the y axis states the outstanding level of debt in sterling millions maturing.

Debt programmes

| Programme Size | |||

| Entity | EMTN | ECP | USCP |

| National Grid plc | €20bn* | $4bn | $4bn |

| National Grid North America Inc | €8bn | €4bn | $4bn |

| National Grid Electricity Transmission plc | €20bn* | $2.5bn | $2.5bn |

| National Grid Electricity Distribution (East Midlands) plc, National Grid Electricity Distribution (South Wales) plc, National Grid Electricity Distribution (South West) plc, National Grid Electricity Distribution (West Midlands) plc | £6bn | - | - |

*Joint EMTN programme size

The Prospectus, Supplementary Prospectus(es) and documents incorporated by reference for each of our EMTN programmes are accessible through the links above.